This article will be helpful for those who are attending an auction for the first time to buy on their terms.

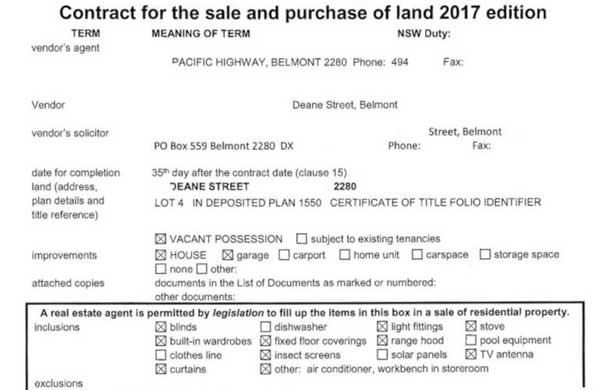

We’ve mentioned many times on our Conveyancing pages that a house must have a contract of sale before it can be publicly listed for sale.

If you’re interested in a property that is going to be listed for auction, it will have a contract available you can request from the selling agent. It is in the buying party’s interest to obtain a copy of the contract and provide it to their Conveyancer/Solicitor as early as possible for review prior to auction day.

A Conveyancer will review the contract, educate their client on the findings and help them strategise the upcoming auction. The Conveyancer may also request amendments or alterations to the contract prior to the auction. That way, the client is prepared for the high-pressure experience and can make confident decisions.

Let’s talk about prerequisites to get right before you start looking at properties.

Pest & building inspections prior to the auction

When buying at private treaty, there is usually a 5-day cooling-off period where the buyer would obtain independent pest and building reports. At an auction, there is no cooling-off period, as contracts exchange immediately, so all pest and building reports must be performed prior to the auction date.

In a typical auction scenario, the vendor will supply their own pest and building reports for the public to access.

Hunter Legal & Conveyancing strongly recommends people organise independent pest and building inspections from professionals in addition to the reports provided by the vendor.

If a report is arranged and paid for by a vendor and the purchaser utilises them, if there are problems, there is no recourse for the purchaser.

While organising inspections can be costly and inconvenient, purchasing a property is likely to be your biggest financial decision. Obtaining your own pest + building reports from a reputable source will provide you with added security and knowledge going into the auction.

Pre-approval of finance

Before attending any auction, or open homes for that matter. It pays to obtain pre-approval from a lender. That way, you know exactly how much you can afford.

With pre-approval in place, you can begin attending auctions or open homes to research the market and understand what properties are within your price range.Additionally, you can understand your serviceability of the loan and make informed judgments when comparing the purchase price of properties.

Deposit bond or cash deposit

For those who are unaware, deposit bonds can be used as an alternative to traditional cash deposits. Deposit bonds can be used when a person is borrowing 100% of their funds for a purchase, or if they’re waiting on funds to be released from a sale or another financial transaction.

Learn more about Hunter Legal & Conveyancing’s deposit bond service here.

If the sale price is above your pre-approval amount

As an example, a person is approved for $600,000, attends an auction however the property will likely sell above their approved amount, let’s say $615,000.

This would be a risky situation and inadvisable.

Assuming the person placed a bid for $615,000 and was the successful bidder. As contracts are exchanged the same day, they would need to obtain $15,000 that day (probably as a gift from family/friends) and also communicate the situation with their lender.

Their lender may or may not accept the changes and could deny unconditional loan approval.

In the event a buyer exchanges contracts however their finance falls through, they would be required to pay a full 10% deposit (i.e. $60,000 if the purchase price was $600,000).

If you are looking at properties and think they may sell for more than what you’re approved for, the best course of action would be to consider cheaper properties or reassess your loan amount by contacting your lender or mortgage broker directly.

Auctions vs private treaty

It’s up to a vendor to decide what selling strategy they will utilise.

Typically, vendors utilise auctions in circumstances that will be beneficial, particularly in a hot market. When auctions are attracting large crowds, buyers may become competitive and end up in a bidding war with other parties, thereby driving purchase prices up. A perfect example is the real estate peak in Sydney between 2016-2018, which was an auctioneer’s dream.

On the other hand, buyers can be perturbed by auctions and the high pressure that comes with them and choose not to attend them. So by using an auction strategy, a vendor may inadvertently limit the number of prospects.

Private treaties are performed by hosting open homes, capturing attendees details and liaising with them in a private manner. Vendors typically utilise the private treaty strategy, especially during cooler markets or for clients who are in no rush.

Reviewing the contract of sale & amendments

Hunter Legal & Conveyancing will review the contract of sale with a high attention to detail, leaving no stone unturned.

In regards to auctions, we pay particular attention to:

- Special conditions (to see if there is anything unfair or unjust for the purchaser)

- Intended use (if the purchaser wishes to perform alterations to the property, or use it in a specific way, we would assist them to make enquiries with the council or relevant authorities)

- Ensuring the contract is complete & contains all the relevant documents required by law

If you are attending an auction and would like us to review the contract, please try us give us at least 24 hours notice. Though, the more time, the better.

We cover sales contracts in our general Conveyancing page, particularly our buying or selling properties pages.

Please note, the vendor does not need to accept any amendments or alterations forwarded to them.

On auction day

Auctioneers are skilled in their profession. It’s their job to pre-qualify the audience to know the serious contenders, then run an auction with every intent to engage the audience, gauge body language, increase emotionality and ultimately raise the sale price.

Hunter Legal & Conveyancing recommend people simply write down the maximum price you are willing to pay for the property and to not exceed this.

Bonus tip – we’ve heard from auctioneers that the people most likely to win an auction, are the first one or two people that place a bid. Bidding early allows you to assert yourself and be recognised as a serious contender, to both the vendor and the public.

Want HLC to perform your conveyancing?

- Our staff are available 24/7 by phone

- We are fully licensed & insured

- You pay Conveyancing prices for a full legal team

If you or someone you know is considering attending a property auction, do not hesitate to contact our office to speak with one of our friendly team members today on 1300 224 828.