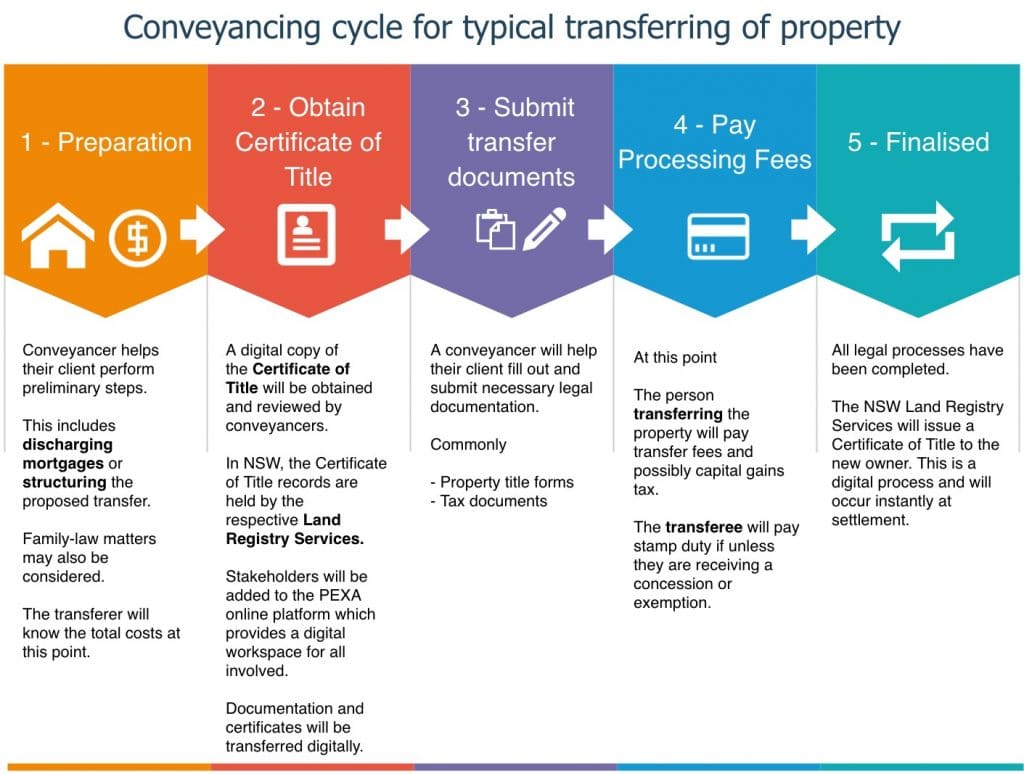

Transferring property in NSW is the legal process of changing the Certificate of Title from one party to another via the NSW Land Registry Services.

THE PROCESS

The below diagram represents the process a person will go through when transferring a property.

TRANSFERRING PROPERTY IN NSW – WHAT YOU NEED TO KNOW

Property transfers due to marriage or separation can be exempt from stamp duty costs, assuming the home is the principal place of residence.

Property transfers to family members for other reasons usually incur stamp duty costs, such as transferring the property to a cousin or sibling.

First home buyers can receive stamp duty exemptions or concessions for property transfers.

In the case of separation, this can create many complexities, such as calculating contributions to a property, caring for children, etc. In this circumstance, it would be beneficial to engage legal representation from a firm that has both Conveyancers and Solicitors.

Types of property ownership

Sole Proprietor – this is when an individual holds the Certificate of Title in their name alone as the sole proprietor of the property.

Joint Tenancy – This is when a property is owned equally by multiple parties, and each person has an equal share in the property. This equal share is not necessarily defined by the number of monetary contributions. For example, if person A contributed 80% and person B contributed 20% of the mortgage, land registries will still view these as equal owners.

In the event of death, a property with joint tenancy noted on the title may be able to be transferred by way of a Notice of Death to the surviving party, without a Grant of Probate.

Company Ownership – this is when a company or business holds the Certificate of Title. An example of this would be a mechanic purchasing a piece of land to conduct business on. There are many considerations here, such as land zoning, insurance, and taxation.

Joint Tenancy – This is when a property is owned equally by multiple parties, and each person has an equal share in the property. This equal share is not necessarily defined by the number of monetary contributions. For example, if person A contributed 80% and person B contributed 20% of the mortgage, land registries will still view these as equal owners.

In the event of death, a property with joint tenancy noted on the title may be able to be transferred by way of a Notice of Death to the surviving party, without a Grant of Probate.

Tenants In Common – In contrast to joint tenancy, tenants in common occurs when multiple people own varying shares in each property. For example, person A could hold 95% of the shares of a property, and person B could hold the remaining 5%.

In the event of death, tenants in common do not possess a right to survivorship. Therefore, the deceased party’s Will is referred to decide upon the new ownership structure.

FREQUENTLY ASKED QUESTIONS

Yes, when there is a mortgage on a property, a bank has control of the Title until the loan is repaid in full and a Discharge of Mortgage process is completed. It is possible that a property with an existing mortgage can still be transferred to a new owner however, the Bank may require the owner to restructure and secure the mortgage against another asset.

If a party has recently repaid their mortgage in full, they must complete a Discharge of Mortgage request form and submit it to their Bank who will then create a Discharge of Mortgage form and submit it to NSW Land Registry Services. This process is now completed electronically and the Mortgage noted on the Title will immediately be removed resulting in control of the Title being granted back to the owner. This means that the owner can sell or transfer the property or take out a new loan and use the property for security without needing the consent of the original Bank to do so.

Generally not. If they are an eligible first home buyer, and the property is valued at under $800,000, they can be entitled to a stamp duty exemption or concession. The transferee will need to complete the normal First Home Buyer Assistance Scheme Form with the assistance of their Conveyancer or Solicitor and satisfy the eligibility criteria.

Yes. We receive a lot of questions relating to different forms of ownership. We can help with outright ownership, joint ownership, trust ownership, company ownership, and any other complex arrangements.

HOW WE CAN HELP

We can offer the following to assist in property transfer:

- Help you strategise and structure the property transfer to align with your goals

- Perform a Title Search on the property (to confirm the owner of the property and the ownership status, as well as if the property is affected by any existing caveats, mortgages, leases, etc)

- Maintain regular communication with all parties, such as banks, and the transferrers to ensure we’re all on the same page.

- Prepare all the necessary legal documentation required and manage the process

- Discuss any stamp duty implications with you.

HELPFUL LINKS

Division of matrimonial property in Australia – Australian Institute of Family Studies

https://aifs.gov.au/publications/division-matrimonial-property-australia/introduction