This page will outline the Conveyancing process for those who are in the process of buying property or making preparations to buy property in the future.

The first steps that a purchaser should take are:

- Deciding on a Solicitor or Conveyancer.

- Requesting a copy of the Contract of Sale for prospective properties.

- Obtaining pre-approval of finance.

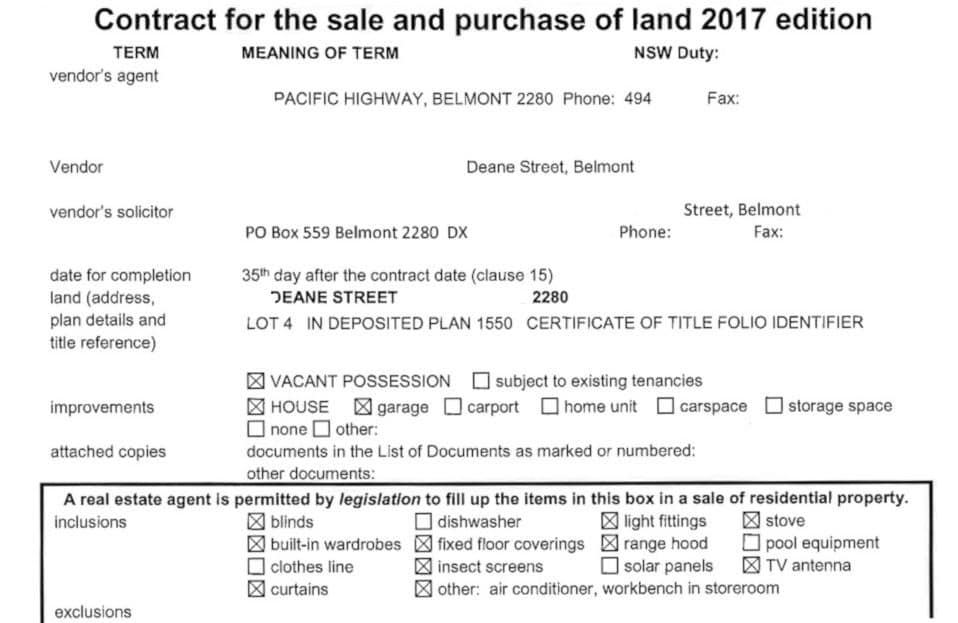

A property must have a Contract of Sale prepared before it can be advertised. This means you can obtain a copy for your Conveyancer or Solicitor to review before attending any auctions or open homes or making an offer. This is advantageous because:

- You can buy on your terms – Occasionally, a selling party may include a clause in the contract that works in their favour, such as an extended settlement period. A Conveyancer or Solicitor can negotiate these clauses and possibly have them altered or removed. Ideally, the contract will be standard and mutually beneficial.

- You can learn more about the property – The contract will include information such as inclusions (i.e. stove and light fittings), exclusions, town planning (i.e proposed constructions that could block your view), zoning, property certificates, cooling-off periods, etc. This information is vital and may affect your original evaluation.

For more information have a read of our “How to Attend an Auction on your Terms” article

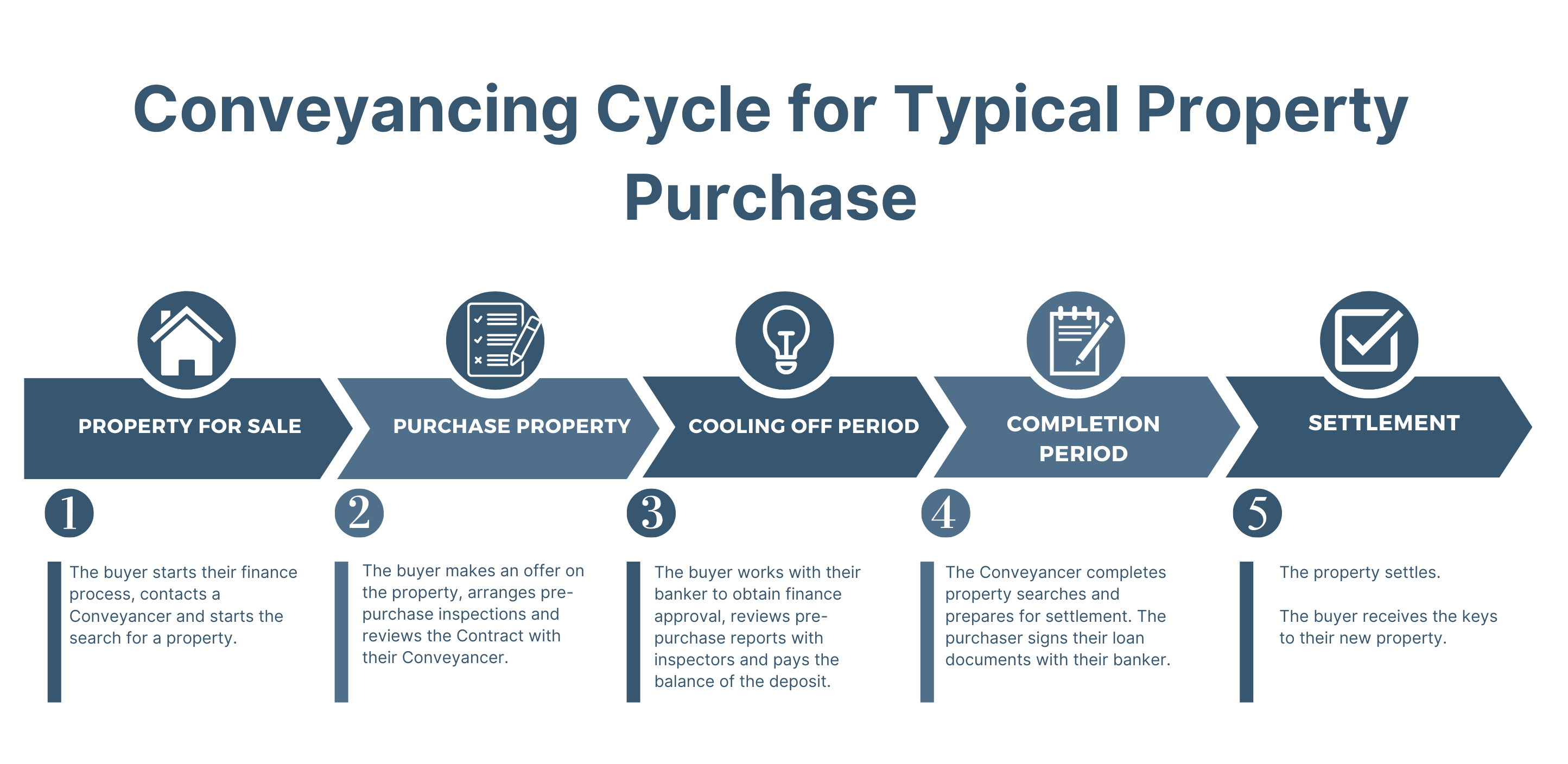

THE PROCESS OF BUYING PROPERTY

The below diagram represents the course a person will go through when buying a property.

BUYING IN NSW – WHAT YOU NEED TO KNOW

Pest and Building Inspections

You are not legally required to acquire pest and building inspections before purchasing a property, however, they are very important. The reports are relevant for knowledge of the property, identifying risks, future maintenance, and can also play a role in negotiations.

When buying at a private treaty – The purchaser should organise pest and building inspections prior to exchanging contracts or, during the cooling-off period after contracts have been exchanged.

It should be noted, that during a private treaty sale, a vendor can verbally accept an offer, allow the person to organise (and pay for) pest and building inspections, and then decide to sell the property to another buyer. This is known as gazumping, and the person will forfeit the costs of the inspections and miss out on the property. You can contact us to learn more about avoiding gazumping.

When buying at auction – The purchaser should organise pest and building inspections before attending the auction. The purchaser or their Conveyancer can organise these inspections with the selling party before the auction, giving the buyer time to consider the findings.

Occasionally, a seller may organise pest and building inspections for their property. When these are performed by a reputable company, it can improve the peace of mind of buyers and potentially increase their interest in a property. In addition to this, buyers can also obtain their inspections, for total confidence.

Please note, that Hunter Legal & Conveyancing can organise fully licensed and qualified professionals on your behalf.

NSW Taxation & Other Costs

Stamp Duty – When purchasing a property, Revenue NSW will impose the payment of stamp duty, which scales with the purchase price. For example, for a property that costs $530,000, the stamp duty would be $19,340. In NSW, first home buyers are currently eligible for an exemption or concession to this duty depending on the price of the property and other eligibility requirements, visit our first home buyers page to learn more.

There are many variations to be considered when calculating stamp duty. Contact Revenue NSW or ask your Conveyancer to calculate this for you.

How do you pay for everything?

The majority of the time, when a person is obtaining a loan to assist with purchasing a property, the bank will also allocate money towards the upcoming legal and associated costs such as stamp duty. The Conveyancer will use these additional funds to pay for the legal costs on the client’s behalf. If you are a cash buyer or contributing some of your funds towards the purchase in addition to obtaining a loan, your Conveyancer or Solicitor will provide you with a breakdown of all costs and direct you as to how your funds are to be made available. For example, they will have you deposit funds into a Trust Account, or, your Bank may hold the authority to debit money from one of your existing accounts.

FREQUENTLY ASKED QUESTIONS

The cooling-off period –is a window of time that a buyer can withdraw from a property purchase. It is usually five business days in length, at which time, a buyer will usually organise pest and building inspections for the property. During this period, a buyer can withdraw from the sale for any reason but will be required to pay 0.25% of the purchase price (i.e. $1250 if the purchase price is $500,000). Cooling-off periods can be negotiated to be removed, extended, or shortened. Cooling-off periods only apply for private treaty sales, when buying at auction, there is no cooling-off period, and the parties exchange contracts immediately. If you’re not sure whether to have a cooling-off-period or unconditional exchange have a read our “Cooling Off Period Vs Unconditional Exchange Article” or our “Cooling Off Period Fact Sheet” article

No. However, if you would like to negotiate a different purchase price and we’re instructed by you to forward this to the selling party’s legal representation, then we can perform this. In terms of directly negotiating with the sales agent on the purchase price, this is not something we can do.

No. After contracts are exchanged, the selling party is legally required to sell.

We would recommend you obtain a copy of the contract and forward it to us for review. We offer upfront Contract reviews so you can make an informed decision when purchasing a property.

As mentioned on our selling property page, a Contract of Sale must be prepared before a property can be advertised. So whether you’re attending an auction or a private sale, you can contact the Real Estate Agent and obtain a copy of the Contract in either circumstance.

Auctions can be high-pressure situations. So by having our Conveyancers peruse the Contract of Sale before attending, you’ll be in a much better position to make a confident decision on the property.

No. In more complex scenarios like this, we often recommend you engage a quantity surveyor, which we can organise on your behalf. A quantity surveyor will be able to perform these calculations for you, so you can make a better financial decision.

HOW WE CAN HELP

If you decide to call HLC and provide us with an overview of your buying situation, we can give you a quote and some guidance over the phone. We do this so:

- You’re aware of the pricing upfront

- You can ask any preliminary questions

- We can obtain the Contract of Sale and review it for free

Fences can cause an array of problems for adjoining property owners. Before purchasing a property, ensure your Conveyancer performs thorough groundwork on the property so you can avoid problems before they surface. For more information read our article on property fencing.

If you would like to read more about the Conveyancing Process in NSW for purchasing property have a read of our “Conveyancing Process NSW Purchase” article

We can guide you through the entire purchasing process. Everything is performed in compliance with the NSW Conveyancing Act. We will also take care of the following:

- Helping you prepare to buy at auction or private sale

- Educating you on the Contract of Sale, and how this affects you both in the short and long term

- Organising pest and building inspections upon your instruction

- Making enquiries about the property, such as council planning and conducting title searches

- Liaising with all relevant stakeholders, such as mortgage brokers, vendors, and councils

HELPFUL LINKS

Calculating Stamp Duty of Land in NSW – Revenue NSW

https://www.service.nsw.gov.au/transaction/calculate-stamp-duty-sale-land-or-businesses-nsw

Property Inspections – Fair Trading NSW

https://www.fairtrading.nsw.gov.au/housing-and-property/buying-and-selling-property/buying-a-property/property-inspections