What is the First Home Loan Deposit Scheme & what are the benefits?

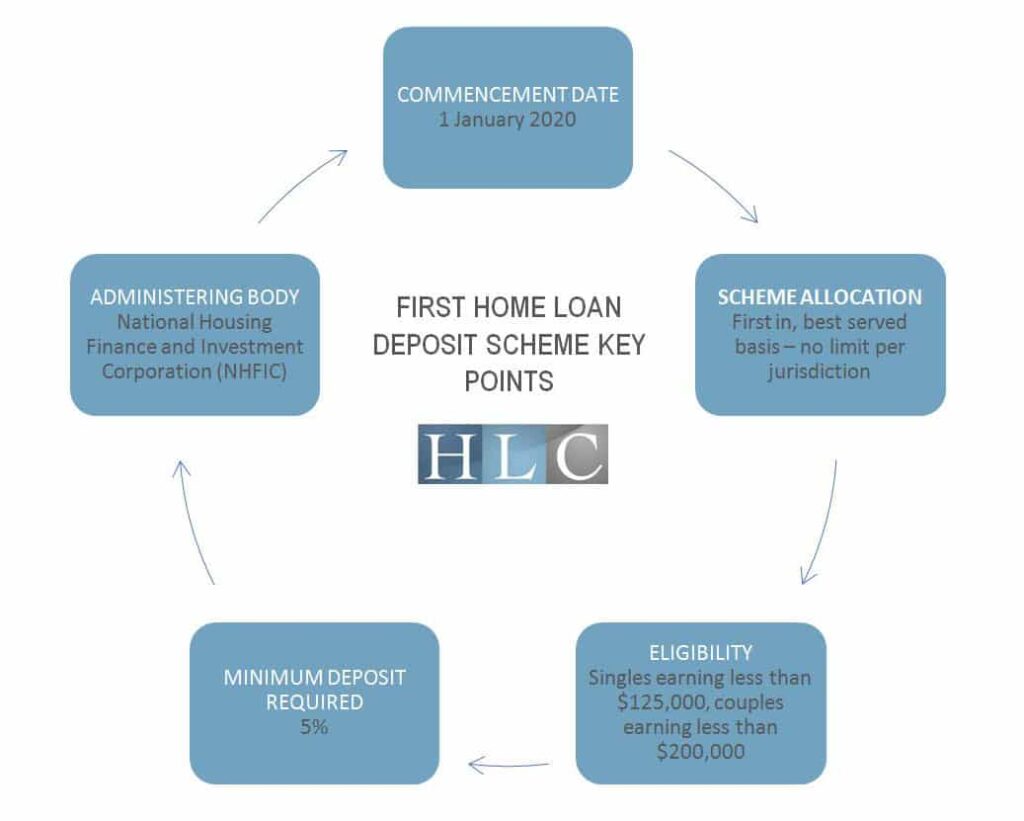

The Australian Government has introduced a First Home Loan Deposit Scheme (first home buyer scheme) to support eligible first home buyers purchase a home faster and easier. This scheme will aim to help up to 10,000 first home buyers with low or middle incomes enter the market each year from 1 January 2020.

Eligible First Home Buyers will be able to pay a deposit of 5% and still avoid lenders mortgage insurance (LMI). Presently most banks require a minimum of 20% as a deposit to avoid paying mortgage insurance so this will help first home buyers significantly as they will be able to pay 5% and the government will underwrite the loan, so the borrows do not have to pay LMI.

How does the First Home Loan Deposit Scheme work?

Step 1: Apply with NHFIC

Step 2: If approved an application can be made for a home loan with a lender using the government as your guarantor

Step 3: Start looking for your new home if you haven’t already done so

The government has estimated that you could save around $10,000 by using them as a guarantor and avoid paying LMI, but the amount you will save will depend on the circumstances of your loan.

You will receive this support for the duration of the loan however if you decide to refinance your home, you will no longer be eligible for this support so if you still owe more than 80% of the value of your property LMI may be payable.

Eligibility requirements for First home buyer scheme

- A single person earning less than $125,000

- couple earning less than $200,000 combined

- 5% of the value of the property intended to be purchased has been saved

- Application has been made before 10,000 people have made their application in any given year

- The property you purchase must be within the price cap that the government has set as below:

What are the Risks?

Taking out a loan with a smaller deposit is a higher risk as the amount owing is going to be more than if you paid a larger deposit. Inevitably this will make a borrower’s home loan repayments more as the maximum loan term remains at 30 years.

This may put more pressure on borrowers to pay back their home loans and borrowers that pay a 5% deposit will also pay more interest than someone who pays a 20% deposit if they pay the minimum repayments as interest is calculated on the amount owed which will be 15% more.

Other information on first home buyer scheme

Housing Minister Michael Sukkar said only two of the big four banks will be chosen to take part in the scheme being Commonwealth Bank (CBA) and National Australia Bank (NAB) and 50 per cent of all guarantees are set aside for the other 25 other smaller lenders.

Interestingly, Westpac was going to be the second lender however in light of the recent money laundering allegations, they have been dismissed as part of the first home buyer scheme.

From 1 January the two major banks will start accepting applications under the scheme and shortly after on 1 February the smaller lenders will start accepting applications.

In the past 12 months, there were nearly 110,000 first home buyers so first home buyer scheme can only cater for a fraction of potential applicants so it is predicted there will be a rush in January with first home buyers trying to secure a property.

For more information about this scheme please refer to the National Housing Finance and Investment Corporation website at https://www.nhfic.gov.au/what-we-do/fhlds/.

We go above and beyond at Hunter Legal & Conveyancing to ensure our fixed fee service includes everything you need to buy and/or sell your property with ease. With over 30 years experience in Conveyancing and with HLC being a 7 day a week service, any questions you may have can be answered immediately. After hours also includes weekends, so if you want to secure your sale and/or purchase quickly you can call our professional Conveyancing team to get your matter underway.

We look forward to assisting you to ensure your property matters are on time and hassle-free.